In recent years, the line between what is real and what is digital has become increasingly blurred. With the rise of virtual and augmented reality, we can now interact with digital environments as if they were physical spaces. This new frontier is called the metaverse.

The metaverse is a persistent, online world where users interact with each other and with digital content using avatars. In this virtual world, users own property and trade goods and services. The virtual world of the metaverse has a developing digital economy around these activities.

One of the new players in this space is Dyme. Dyme is a digital asset platform that is laying the social and financial groundwork for the decentralized web. Dyme gives metaverse development creators the tools to build a digital economy. As a cryptocurrency, Dyme enables users to buy, sell, and trade digital assets in the metaverse. In other words, Dyme accelerates the growth of the metaverse economy.

So what exactly are digital assets? How can you get started investing in them? Can you even invest in them? How does Dyme work in the virtual world of the metaverse? Keep reading to find out.

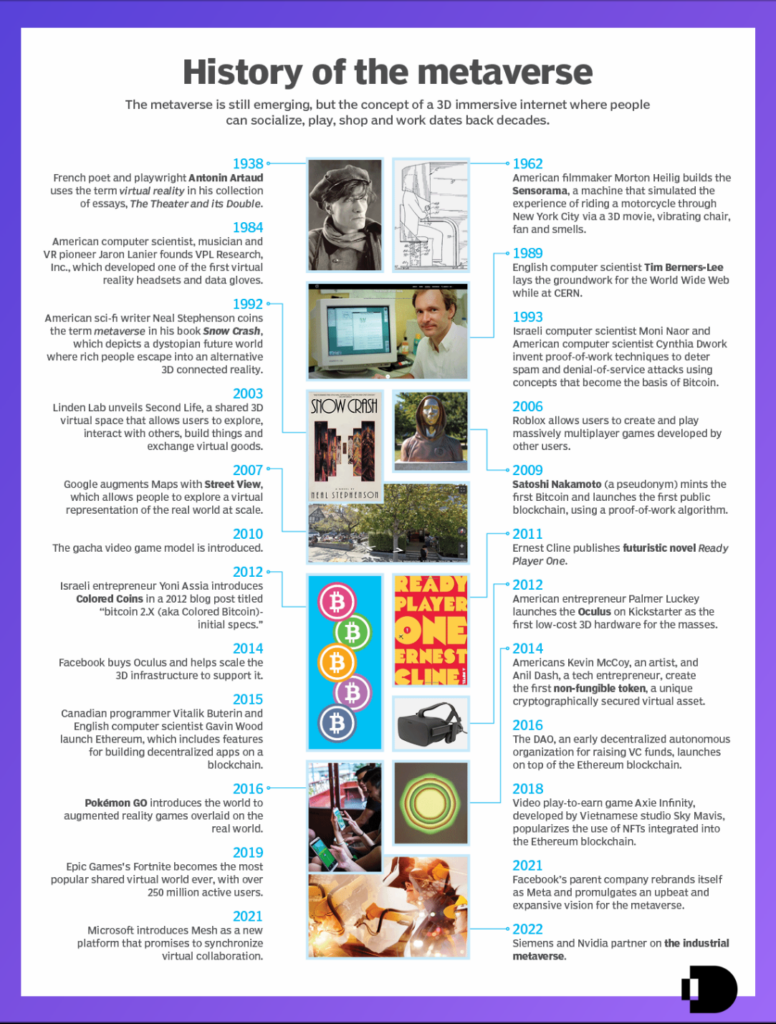

What is the metaverse? A short history

The metaverse term originated in Snow Crash, a 1992 science fiction novel by the American writer Neal Stephenson. The 2003 virtual world platform Second Life is often described as the first metaverse, as it incorporated many aspects of social media into a persistent virtual world with the user represented as an avatar.

Virtual reality was a term first used in a 1938 essay by French poet and playwright Antonin Artaud, long before computers or the internet. Similarly, cyberspace was first used in the late 1960s by Danish artist Susanne Ussing. Both terms have come to align with a computer-generated shared virtual space, and thus the three terms, metaverse, virtual reality, and cyberspace, are often used interchangeably.

More recently, Meta’s Horizon Worlds (recently renamed MetaHorizon) has shown how a VR space can work. Using their Meta Quest headset, one of the top VR headsets in the market, users can engage in a wide range of virtual experiences. While it requires a VR headset, it’s a cool, powerful example of one of the big facets of the metaverse.

What is the metaverse? An explanation and in-depth guide

To explain the metaverse, we should probable first define the term metaverse!

The metaverse is a persistent, online world where users interact with each other and with digital content using avatars. Just like in the physical world, users own property and trade goods within the metaverse. And also, like the physical world, there is a thriving economy around these activities.

Digital humans in virtual worlds

Beyond the virtual worlds being built and used today, the metaverse is also a vision of what many in the computer industry believe is the next iteration of the internet: a single, shared, immersive, persistent, 3D virtual space where humans experience life in ways they could not in the physical world.

Some of the technologies that provide access to this virtual world, such as virtual reality (VR) headsets and augmented reality (AR) glasses, are evolving quickly; other critical components of the metaverse, such as adequate bandwidth or interoperability standards, are probably years off or might never materialize.

Metaverse technologies have been gaining traction recently as technology companies build virtual spaces with greater fidelity. At the same time, users are increasingly open to a virtual reality experience as the need for global connection and socially distant interaction grows. This has led to the creation and use of virtual worlds where people come together, build and explore without the limitations of physicality. This guide provides an overview of the metaverse, its features, and potential applications so that readers can gain perspective on this digital universe and how it could shape our future.

Dyme’s role in this mixed reality is to provide economic structures to stitch these virtual worlds together. Part virtual currency, part community governance, part economic structures, Dyme’s community of innovators and creators focuses on building an interoperable economy across the metaverse. The metaverse presents a chance for many users to connect, socialize, spend, and earn. Dyme is working to provide a valuable interoperable network of currency and financial exemplars to make that chance a reality.

Metaverse visions blend multiple technologies into multiple worlds

At its core, the metaverse is a shared online space that functions similarly to a digital universe, with people from all over the world connecting via devices like smartphones, tablets, and computers. Within this 3D space, users can explore detailed virtual worlds created by others or create their own. These digital environments are rendered in real-time using advanced graphics capabilities. In newer cases, these virtual worlds are enabled by artificial intelligence (AI) and machine learning (ML) technologies.

In addition to using avatars as the basis for near-human interaction in virtual reality, the metaverse also allows for social interactions between users through voice chat, video chat, and text-based messaging. People can use their avatars to represent themselves in these virtual settings — further immersing them into a completely new world. Furthermore, augmented reality (AR) techniques bring elements of the physical environment into this sophisticated digital landscape — making it even more realistic. Lastly, blockchain technology serves as an infrastructure layer within the metaverse — allowing all transactions to be securely stored on an immutable ledger.

An economic platform for digital spaces

But “storing all transactions on an immutable ledger” is sort of dry. The right cryptocurrency has the potential to power the metaverse economy and help it grow. That’s equal parts powerful, cool, and transformative for metaverse technologies.

Given its intricate combination of underlying technologies and numerous possibilities for virtual experiences resulting from those combinations, the metaverse is disruptive enough to revolutionize our current way of life. There have already been talks about various applications such as education, healthcare, and entertainment that could benefit greatly from these immersive online platforms — though few have been implemented yet.

Digital avatars rocking out

One example of an intriguing application for the metaverse is virtual concerts — where musicians would play live shows for attendees worldwide who are represented by their avatars in an interactive 3D environment.

This would enable more people than ever before to experience live music from any location — thereby eliminating geographical barriers that often prevent shows from taking place in certain areas due to cost restrictions or other reasons. Moreover, this opens up new opportunities for independent artists who may not have had access to costly resources necessary to organize large-scale events before this technology became available.

In 1991, Moscow hosted the Monsters of Rock festival. Over 1.6 million people attended the concert. No tech giants, no tech companies, no digital twins, just a lot of people experiencing awesome music in the real world. It was more than a concert since it was held in Moscow in 1991. It was a political, social, and global moment.

Imagine how enormous a global moment like the Moscow festival could be in a virtual environment. The power of the virtual world is that it further shrinks the real world in much the same way as the airplane.

Real-world office spaces meet extended reality

Besides concerts and other entertainment applications, business collaboration can benefit greatly from these cutting-edge platforms. Virtual meetings are the first thing everyone talks about, but enabling new economic activities is a much broader topic. Virtual reality opens up possibilities that may not be possible in the real world for cost or distance reasons.

Similarly, augmented reality can create a mixed reality where users can both gain the benefit of working from home and the social connection of interacting in an office environment. Where a digital twin would be the user’s avatar in VR social metaverse, virtual workspaces can use extended reality to blend human interaction with metaverse technology. This can answer the problem of social interaction in the workplace raised by Business Insider

Business models adapt using metaverse technologies

When real-life issues like a pandemic impact work and society, businesses can adopt augmented reality experiences to continue operations.

For instance, large companies could leverage these platforms for conferences or meetings between their employees located around different parts of the world. Small businesses might take advantage of virtual marketplaces, which offer increased reach at lower costs than traditional brick-and-mortar establishments or existing e-commerce platforms. Even entrepreneurs with limited resources can set up localized stores without worrying about renting physical space or investing heavily in constructing retail shopfronts.

Game developers make 3d virtual worlds for more than games

Game consoles are terrific. PC games are classic and powerful. The work of game developers to make immersive environments in games like Myst, Everquest, and Fallout 3 speaks to the desire of many users to access a world outside their own. Using the word metaverse is tough without including how users access games to experience an alternative, immersive reality.

The mainstream success of games speaks to the potential for meta platforms to similarly succeed. One flaw many games have is in their fragmented, often isolated economy. While game users have accepted this isolation, they’re more likely to play a game in a shared economy.

As spatial computing grows more powerful, AR will become more lifelike. This has literally a game-changing impact as games will evolve beyond consoles and start to look like what was previously science fiction. The tech industry saddled us with data collection as a business model; they can help the world by making this more democratic and open.

Dyme intends to play a key role in the democratic, open metaverse.

Digital assets in digital space: Dyme and the economy of the metaverse

Dyme doesn’t make a virtual reality headset. We don’t have a video game. We don’t even build augmented reality glasses. What we have are a particular set of skills. Dyme is a digital asset platform that is laying the social and financial groundwork for the metaverse and the decentralized web.

While tech giants are fighting over which VR headset is better, Dyme has been focused on a niche real-world problem: building economic models and a technology that can work across multiple platforms to serve as an underpinning economic foundation for the metaverse. Whether virtual reality, mixed reality, or augmented reality, one real-life problem exists in them all. The problem is the need for a common medium of exchange.

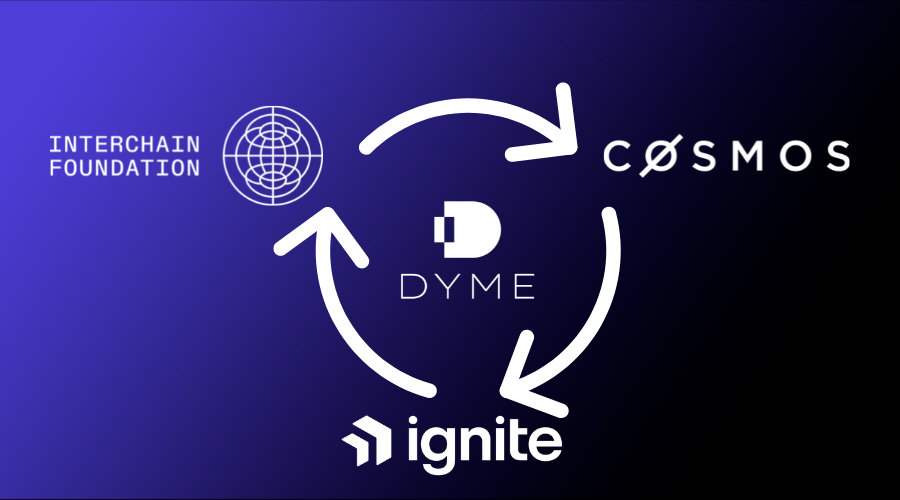

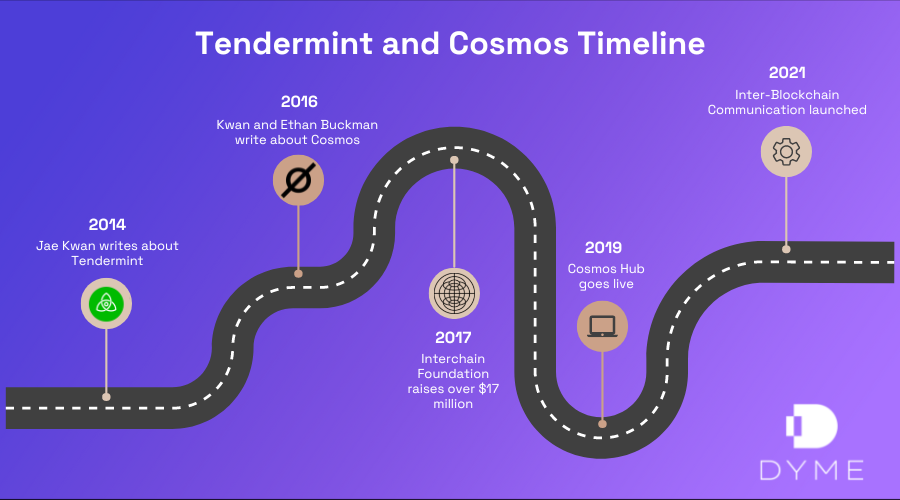

The power of Cosmos and Ignite

Dyme is built using Ignite CLI (formerly Tendermint BFT) and the Cosmos SDK framework. By transforming a decentralized blockchain network structure into a generalized consensus engine, Ignite provides a platform for interoperable, sovereign decentralized networks that resembles the early days of the world wide web and the very first e-commerce transactions. When combined with the Cosmos SDK, Dyme has a platform to create the natural next step for the future of the metaverse and Web3: a cross-network cryptocurrency, a decentralized but standardized economic engine for the decentralized internet.

Virtual objects, digital assets, and virtual avatars all have persistent value

The digital world is new and growing. The value of assets in the digital world are much more volatile than those in real life. At least, that’s a common thread in media articles about the metaverse.

The thread has validity in a mature economy. Digital real estate is much more volatile than real estate in Kansas, for example. In a less mature economy, the examples are less precise. Essentially, comparing the economy in the metaverse to the economy of the United States is unhelpful.

Dyme’s thesis is that interoperability will drive persistent value for virtual goods, services, assets, and objects.

More helpful is a recent publication from the Pew Research Center writing about the metaverse in 2040. The paper speaks about the potential for usefulness, the need to avoid today’s dominant platforms, and the effort to mature the foundational systems of the metaverse.

Returning to the roots of an open, friendly Internet

The heightened interest and investment in extended reality prompted Pew Research Center and Elon University’s Imagining the Internet Center to ask hundreds of technology experts to share their insights on the topic. One significant theme was returning to an open, friendly Internet.

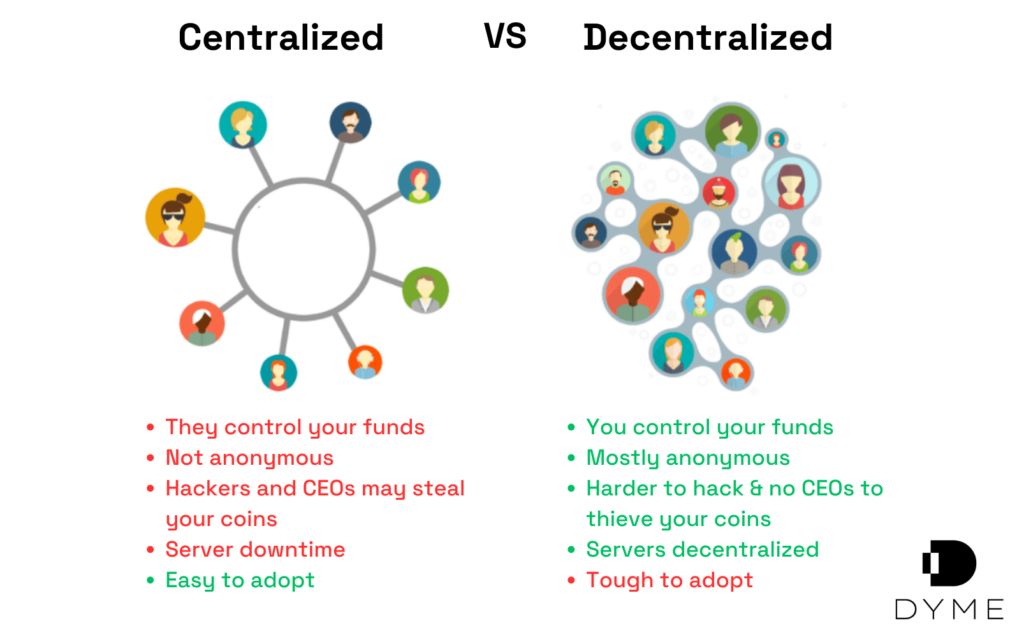

The Internet developed primarily because of decentralized governance. The Internet Engineering Task Force was developed as a community of engineers and scientists, often from competing companies, to share ideas, protocols, and structures that became the foundational elements of the Internet. With no formal membership roster or requirements, the IETF works to create voluntary standards that maintain and improve the interoperable network.

The metaverse and Web3 need entities similar to the IETF. For the currency and economic structure, Dyme’s structure as a DAO satisfies the key elements the IETF got right: voluntary, democratic, open, focusing on bottom-up creation, and open standards.

Avoiding the pitfalls of crypto that isn’t purpose-built for the metaverse

The Chainalysis 2023 Crypto Crime Report said more than 1.1 million tokens were launched in 2022. Just 40,521 of them achieved minimal traction. That’s just under four percent.

Fewer than 4% of all tokens launched in 2022 achieved a minimum of 10 swaps and four consecutive days of trading in the week following their launch. And about 25% of those who showed traction lose 90% of their value in the first week of trading.

In that environment, the need for a purpose-built economic structure for metaverse and Web3 builders is obvious. Even if metaverse companies picked one of the winning 30,000 out of the 1.1 million that failed to thrive and avoided the 10,000 that plummeted in value, is the currency suitable for the purpose of underpinning one virtual world’s currency and interoperating with others?

Dyme views itself as a community of like-minded creators and helps shepherd the economic policies and the growing metaverse creator community toward greater economic interoperability.

Closing

The economic structure seen in Web 2.0 treats users like merchandise.

The computing power of current social networks is directed at monetizing users and user-generated content.

The siloed nature of tech giants risks the growth of mixed reality. The metaverse differs from e-commerce, social networks, and chat. Metaverse refers to the potential for immersive, positive, supportive worlds beyond our own.

Rather than a zero-sum game of winners and losers seen in Web 2.0, public blockchains and integrated blockchain networks can blend both the size of the existing Internet economy and the growth of the emerging economy of the metaverse. This is where Dyme is positioned: by avoiding this zero-sum game scenario, the Dyme cryptocurrency can evolve into an egalitarian, decentralized entity with persistent, growing value.

Dyme puts control back in the hands of users. That’s how Dyme adds value to the metaverse.